I’ve written before about the appeal of partnerships and Peloton’s recent deal with United Healthcare (UHC) is another example of why this can be extremely powerful. Beginning in September, UHC customers on employer sponsored plans will get complimentary access to Peloton’s digital subscription for one year. Afterwards, customers can continue and pay Peloton directly or simply let the subscription lapse. We’ve seen trial deals on entertainment subscription products now for a few years (think Netflix and TMobile, Verizon and Disney+, Hulu & Spotify, etc), with more likely in the pipeline. All of these services struggle with high customer acquisition costs and partnerships are an extremely effective way to grow.

What do Peloton, Express, Urban Outfitters and J.Crew all have in common? They have items for sale on their websites that aren’t actually theirs. Each of these retailers has taken a page out of Amazon’s playbook and decided to build a 3rd party marketplace of brands to complement their core offering. The main objective is twofold – increase traffic to their site while providing an opportunity to create a new revenue stream.

The WSJ had a piece recently on the rise of virtual brands in the restaurant space. Such a novel idea. Given the rise of super delivery apps (DoorDash, UberEats,GrubHub, etc), legacy restaurants such as Chili’s and Applebees can quickly develop new brands that cater to a digital audience. In one such example, Chili’s was able to spool up a completely new virtual brand with no physical stores called ‘It’s Just Wings’ and grow it to $150m in one year – that’s roughly 5% of Chili’s total business. Furthermore, they can keep their costs to a minimum with no massive advertising budgets, additional leases or significant overhead. Even after accounting for fees tacked on by the delivery apps this business is likely highly accretive. In fact, the majority of customers had no idea that this food was even being prepared at a Chili’s restaurant which shows having a virtual brand can help create new, non-cannibalistic revenue streams, and serve as an incubator for new food concepts. Startups and ad agencies should take note as there is ample space to create new businesses around this changing landscape.

What’s at stake is a massive TAM expected to hit $1T by 2030 made up exclusively of virtual brands and ghost kitchens. Similar to the private label business in grocery, get ready for a crowded, opaque market where it’s harder to tell where or by whom your food was created.

When I was at Jarden (now Newell Brands), we always had clear acquisition criteria when it came to M&A.

- Strong cash flow characteristics

- Category leading positions in niche markets

- Products that generate recurring revenue

- Attractive historical margins / or margin expansion opportunities

- Accretive to earnings

- Post earnout EBITDA multiple of 6-8x

This strategy allowed us to grow from one brand (The Ball Jar company in 2002) to over 50 brands and ~$8b in sales by 2015 when the company merged with Newell Rubbermaid.

I continue to see the surplus of food delivery companies and F&B marketplaces on an impending crash course. Is DoorDash a retailer, a logistics company, a brand, a restaurant or even a media/data company? Their vision is likely to be a bit of each and this will be accomplished under a build, partner, buy framework. Like numerous other industries, the idea of a horizontal play has turned vertical and we’re starting to see each encroach the other’s territory. The challenge in the future will be how to become the super app that customers interact with daily. This fight for share is not without challenges. The average smartphone user has 80 apps on their phone, but they only use ~9 apps per day and 30 apps per month. This means that 62% of those apps don’t get used much, if at all.

Brands aren’t built overnight. Some of the most successful brands (Nike, LVMH, etc) have taken years to achieve the awareness (and more importantly relevance) they have now. In the case of LVMH, there is a key element to owning a piece of European heritage that has driven the company to be the largest luxury goods company in the world. Louis Vuitton owns much of their own supply chain. As an example, over the past couple of years they opened a manufacturing center in Texas to create leather goods here in the US that further allows them to create local stories around their products.

When Twitter ($TWTR) announced last week that they were permanently suspending the President’s personal account I was surprised – but I really don’t think they had an option. It’s very clear that Twitter’s growth has been heavily influenced by Trump and I expect the company will see user attrition as a result. Already, over the last few days, their stock has been falling. That said, there was no way out here. The simple fact is that Twitter makes money from advertisers and this cohort is about as risk averse as can be. Brands don’t want to be next to controversial rhetoric so they often will blacklist platforms or services that could be considered threatening. During my time at Jarden when I was overseeing our global advertising, we were constantly tweaking our buys to avoid anything that could be considered controversial. If Twitter had done nothing, while their user base would likely have remained robust, their earnings would have fallen precipitously as advertisers abandoned the platform. This, also likely would have been a jolt to the stock – and ultimately their business model.

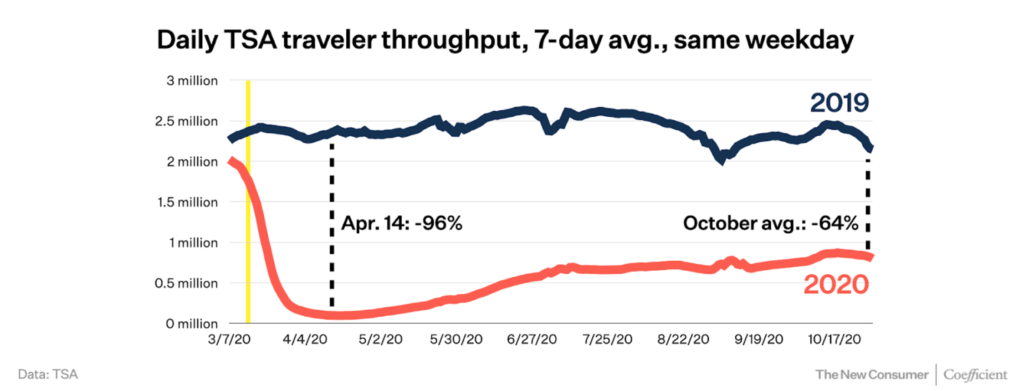

Happy New Year! When I see a chart like the above, it’s unfathomable to believe that it’s a good time to be in the airline business, let alone be a startup trying to enter the capital intensive sector. But that’s what David Neeleman (the founder of JetBlue) plans to do. History is littered with failures of upstart airlines due to a myriad of factors that make it an extremely difficult sector to compete in. Today’s 3 large legacy carriers (Delta, United and American) are the result of years of consolidation and currently control ~50% of the US market.

This is the first year that sales on Cyber Monday are expected to exceed Black Friday, but then of course, this year is anything but normal. I’ve never been a fan of the whole holiday shopping frenzy. As food lines extend miles and millions of people remain unemployed, it’s more important than ever to give back this year.