Startups usually focus on pain points that consumers have found with large bureaucratic companies. The old guard typically misses the signs when an insurgent brand comes on their turf, or they simply believe it’s not going to be a threat. Meanwhile this gives the entrepreneur time to build up a small loyal group of customers. As a result of corporate venture capital teams, and an increased interest in following startup land closely, corporations are no longer sitting back idle while startups take share.

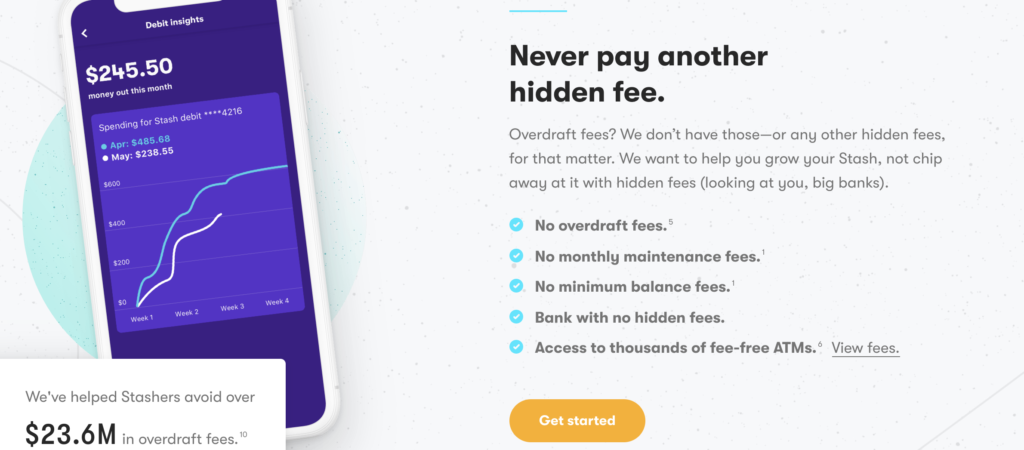

Consider the world of retail/consumer banking and the complicated fee schedule they’ve socialized. Overdraft fees, foreign exchange fees, low balance fee’s, etc. The sad reality is the ones who get hit with these the most are the ones who earn the least. These underprivileged individuals can’t get ahead. They can’t learn to invest, because they are getting burdened with fees and lack of education on how to build a financial cushion. Then startups like Stash Invest or Chime come in and create a transparent model with little/no fees.

They create a simple to understand platform whereby your purchases can also earn stock in companies through partial shares. Now, for example, if I shop at Chipotle once a week and swipe my credit card, I’m also becoming a shareholder in the company. This gave Stash a competitive edge but the incumbents weren’t going to just sit around. Fidelity recently launched fractional shares whereby consumers can purchase partial shares. Robinhood subsequently also began offering the same benefit. It’s just a matter of time before Vanguard and other legacy brokerages follow course. On the flip side, Robinhood turned the industry upside down with $0 trades, but now Vanguard, Fidelity and others offer the same benefit. In the mattress industry, Casper, Purple, Nectar and others created digitally native vertical brands that were primarily direct to consumer. Tempur-Pedic then decided they would create Tempur-Cloud and do the exact same.

The landscape is littered with examples of incumbents coming back around when they missed the boat to try and claw back business. Below are a few initial ideas on how to manage this.

- Startups should prioritize developing a loyalty program early on to build further brand affinity and reduce the potential for churn (or brand switching).

- Continue focusing at the core on creating a frictionless customer experience – even if the competitor offers the same feature set, it doesn’t mean it will be as smooth. In many cases it won’t be as good of an experience as corporations rush these types of programs for fear of losing share. You must always keep the experience less cumbersome than the incumbent. I also advise against trying to one up the other. While corporations have margins to protect, they also have deep pockets. If you try to beat then on various metrics you may be potentially starting a race to the bottom.

- Consider a partnership with the incumbent if details can be mutually worked out. I’ve seen some partnerships really be a win-win.