With news today that Bob Iger is returning to Disney as CEO after a roughly 3 year hiatus, it’s pretty clear that one of the main motives for this move has been the highly un-profitable Disney +, the company’s streaming arm, or as some call it, the new ‘cable’ bill. Like many companies that have legacy wholesale relationships, Disney is trying to make the economics of selling content directly to consumers sustainable. There are a lot of similarities between all the DTC brands today (Warby Parker, Casper, Away, AllBirds, Blue Apron, etc) and Disney+.

To wit, they all vastly underestimated the marketing costs to acquire a customer. Disney historically has sold content through third party intermediaries/pay-tv operators (Comcast, etc) whereby they were bundled as part of large packages the cable companies would sell to their customers. This allowed Disney to focus on making great content why third parties were responsible for building awareness (marketing). The downside to this model was they got paid less per subscriber. So what did they do? They built Disney+ as a standalone offering whereby they could sell their content directly to customers. In Disney’s latest quarter, the company lost a whopping $1.5b on Disney+ alone – even though revenue and active subs were up. By my estimate, Disney’s marketing costs for the streaming product are ~40% of revenue. That’s a substantial number compared to the original model of selling through third parties. Furthermore, in order to grow subscribers, Disney partners with communication companies like Verizon that offer the service to customers through their cell phone bills and loses 15-20% per plan sold here.

The last piece of the puzzle is the cost of content. Many legacy brands build direct to consumer sales channels with the goal of providing an outlet to sell new or custom products that provide differentiation. This is why Disney has spent significant amounts of money producing new content exclusively for Disney+. They are using it as a forum to test new programming and even hopefully launch new entertainment franchises. This all sounds great, but content is expensive. And the risk of creating a show for streaming that flops is an expensive gamble.

As alluded to earlier, Disney+ is not alone in their struggle to make a direct to consumer offering work. Consumer product companies like AllBirds, Warby Parker, Peloton, etc are mostly unprofitable, facing rising costs to acquire customers, and increasing complexity building products for fickle audiences. All problems that were less pronounced when brands sold products through legacy retail channels.

So what’s next for Disney+? Well, they are doing all the common things one would do with an unprofitable endeavor – raise prices, create new bundles (in this case one that is ad supported). But taking a page from DTC brands, the biggest opportunity is loyalty – offering perks for Disney+ members to go to Disney’s theme parks, etc. There’s also the ability to offer credits towards sneak peaks of new content that subscribers get by engaging in the app. And even offering annual renewal incentives. One of the most powerful tools a marketer has is referrals. Knowing how high Disney’s customer acquisition costs are, imagine incentivizing your most loyal customers by paying them to ‘refer a friend.’ DTC brands have done this since inception, but I haven’t seen much of it in the streaming world.

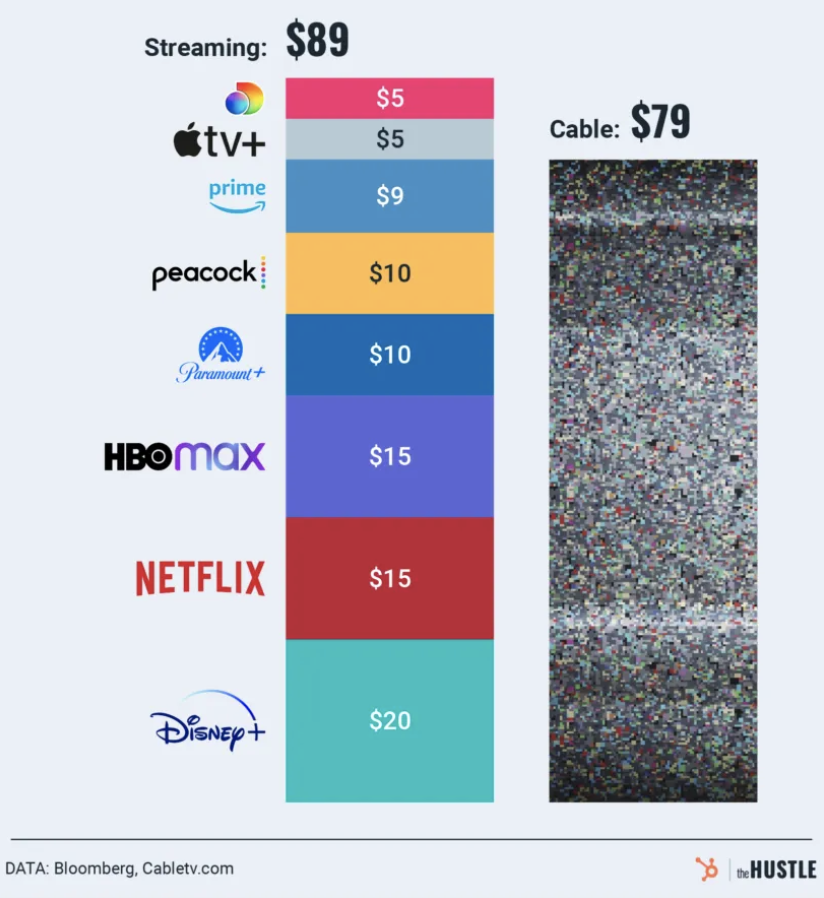

That said, there is no silver bullet here. My contrarian perspective is eventually the industry becomes so fragmented that it morphs back into something that resembles….wait for it….cable.